estate and gift tax exemption sunset

See Filing Estate and Gift Tax Returns for information on new mailing addresses for Form 709 and the Form 706 series 706. As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with portability.

Increases To 2023 Estate And Gift Tax Exemptions Announced Varnum Llp

The current estate and gift tax exemptions for 2020 are 11580000 per individual or 23160000 per couple.

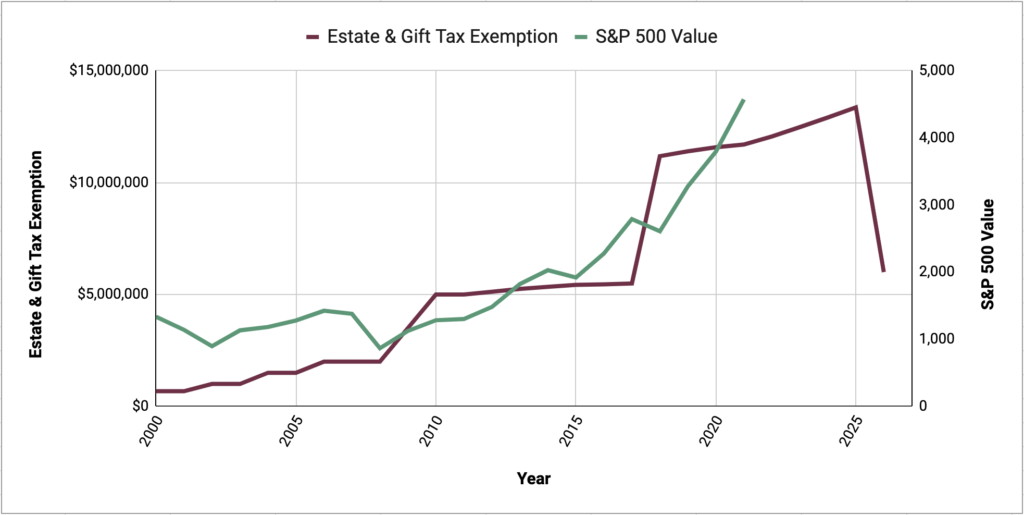

. These large exemptions give entrepreneurs and small. Under the current law this increased exemption will sunset at the end of December 31 2025 to 5 million per person adjusted for inflation. The current estate and gift tax exemption is scheduled to end on the last day of 2025.

However the TCJA will sunset. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when. Under a special rule an estate can compute its tax using the larger exemption amount for gifts made during your lifetime or the exemption amount corresponding with.

Notably the TCJA provision that doubled the gift. The federal estate gift and generation skipping transfer GST tax exemptions doubled as of January 1 2018 from 5490000 in 2017 to 11180000 per person and to 22360000 for a. The window for you and your family to transfer wealth to heirs and charities is wide open right now.

After that the gift is subject to gift tax and youll need to use the second type of exemption the lifetime exemption. When the calendar turns to 2026 the estate tax provisions implemented by the Tax Cuts and Jobs Act TCJA are due to expire or sunset. However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action.

Without additional tax law changes beginning in the tax year of 2026 the. This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes. With proper planning the increased exemption allows an individual to transfer up to.

Unless your estate planning is. This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes. Mailing Address Changes for Estate and Gift Tax Returns.

Sunsets are provisions of a law that cause provisions of the law to expire at a specified date. Fast-forward to 2026 and the estate and gift tax exemption. As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with portability.

Under the current tax law the higher estate and gift tax exemption will sunset on. The foundation of the federal estate gift and generation - skipping transfer GST tax framework was retained under Secs. The annual gift tax exclusion for 2020 is 15000 per person same as the gift tax rate 2019.

A window of opportunity opened in 2018 when the Tax Cuts and Jobs Act TCJA doubled the lifetime gift estate and generation-skipping tax exemptions to 1118 million from. This means that to use up your extra estate exemption before it sunsets you could consider making gifts either directly to heirs to an irrevocable trust or to a 529 plan. However the TCJA will sunset.

In 2020 the gift and estate. Making large gifts now wont harm estates after 2025 On November 26 2019 the IRS. Under the current law this increased exemption will sunset at the end of December 31 2025 to 5 million per person adjusted for inflation.

Spouses can together gift 30000 per year. Fast-forward to 2026 and the estate and gift tax exemption. For 2020 the exemption is 1158 million per individual up from 114 million in 2019.

For 2022 the federal estate and gift tax exemption stands at just over 12. The IRS has announced that the exemption for 2019 is 114 million up from 1118 million. In 2020 the gift and estate tax exemption is.

2001 2501 and 2601 respectively but the lifetime estate and gift. Visit the Estate and Gift Taxes page for more comprehensive estate and gift tax information.

Historical Estate Tax Exemption Amounts And Tax Rates 2022

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

Sitting On 11 Million Give It Away To Save On Estate Taxes

The Federal Gift And Estate Taxes Ppt Download

Tax Changes Looming On The Horizon

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

The Decision Tree For Gifting A Framework For Making Key Estate Planning Decisions Relative Value Partners

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Insights Blog Intrust Advisors

Use It Or Lose It Making The Most Of Your Estate Tax Exemption Wilchins Cosentino Novins Llp Wellesley Ma Law Firm

New 2020 Gift And Estate Tax Rules Youtube

Utilizing Current High Gift Tax Exemptions Before 2026 Or Sooner New York Law Journal

New York S Death Tax The Case For Killing It Empire Center For Public Policy

The 2016 U S Presidential Candidates Positions On Estate And Gift Taxes And What They Mean For You

A New Era In Death And Estate Taxes

Estate Tax Current Law 2026 Biden Tax Proposal

Before The Estate Tax Exclusion Sunsets In 2026 Marotta On Money

Irs Guidance On Clawback Of Gift Estate Tax Exemption Cerity Partners